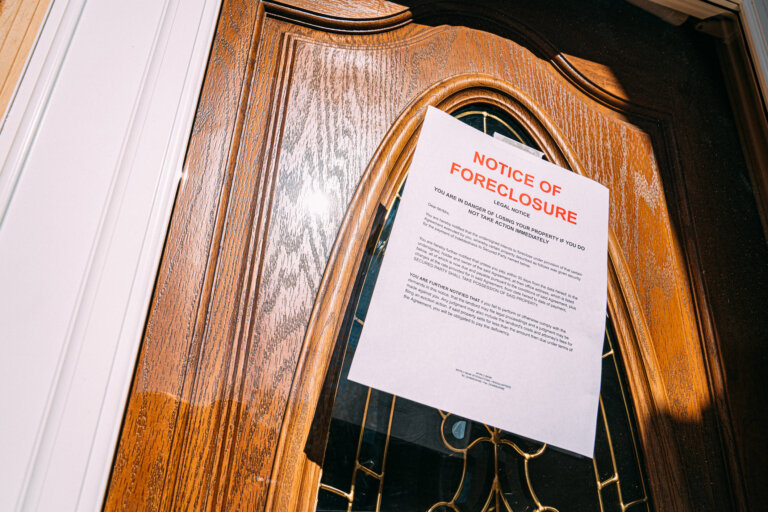

Foreclosure can feel like a heavy weight on your shoulders, affecting more than just your home—it impacts your financial confidence. Many people who go through foreclosure worry about what it means for their credit and future opportunities. While it’s a difficult experience, it’s not the end of the road. Financial setbacks happen, but they can also be overcome. With the right mindset and steps, it’s possible to recover and rebuild, turning this challenging chapter into a stepping stone for a stronger financial foundation.

What Happens to Your Credit Score During Foreclosure?

Foreclosure can significantly lower your credit score, often by 100 to 160 points or more, depending on your credit history and starting score. For those with a higher score, the drop may be more severe because lenders view foreclosure as a major indicator of financial risk. Once the foreclosure process begins, it’s recorded on your credit report, and the impact can last for up to seven years.

This change in your credit can make it harder to secure loans or qualify for favorable interest rates in the future. However, it’s not just the foreclosure itself that affects your score—late or missed payments leading up to foreclosure also contribute to the damage. Despite the immediate impact, your credit score can recover over time with responsible financial habits. By addressing the situation and rebuilding, you can minimize the long-term effects and start moving toward financial stability.

How Foreclosure Affects Your Financial Opportunities

Foreclosure not only impacts your credit score but also limits your financial options for years to come. Lenders and landlords often view foreclosure as a red flag, making it more challenging to access opportunities that require strong creditworthiness. Some of the financial hurdles you may face include:

- Difficulty obtaining loans: Many lenders are hesitant to approve mortgages, car loans, or personal loans after foreclosure. If approved, you may face higher interest rates.

- Challenges renting property: Landlords often perform credit checks, and a foreclosure can make it harder to secure a rental lease.

- Limited access to credit cards: Issuers may deny new credit card applications or only offer options with high fees and low limits.

These challenges can feel overwhelming, but they aren’t permanent. By addressing these obstacles strategically and focusing on credit repair, you can work toward regaining financial freedom and stability.

Steps to Rebuild Your Credit After Foreclosure

Recovering from foreclosure takes time, but it’s entirely possible with consistent effort and smart financial choices. Here are practical steps to help you rebuild your credit and regain financial stability:

- Review your credit report: Obtain a free copy of your credit report from the major credit bureaus. Look for inaccuracies, such as incorrect late payments or account balances, and dispute any errors.

- Pay bills on time: Late payments can further damage your credit, so make it a priority to pay all bills—credit cards, utilities, or loans—by their due dates. Setting up automatic payments can help.

- Consider secured credit cards: A secured credit card, which requires a cash deposit, can help you re-establish credit. Use it for small purchases and pay the balance in full each month.

- Reduce your debt: Focus on paying down any existing debts to improve your credit utilization ratio, a key factor in your score.

- Build an emergency fund: Saving for unexpected expenses can help you avoid future financial setbacks.

By sticking to these steps and practicing responsible financial habits, you can gradually rebuild your credit, restore your confidence, and create a stronger financial foundation for the future.

How We Can Help You Avoid or Mitigate Foreclosure’s Impact

At the Law Offices of Jeffrey A. Herzog, P.A., we understand how overwhelming foreclosure can feel, and we’re here to provide personalized guidance tailored to your situation. Our team works with you to explore options that could help you avoid foreclosure altogether, such as loan modifications, repayment plans, or refinancing. If foreclosure is unavoidable, we can help you minimize its long-term impact by guiding you through bankruptcy options or negotiating with your lender.

We know that every financial situation is unique, and we’re committed to helping you regain control and protect your future. By addressing the issue proactively, you can take steps to rebuild your credit and financial opportunities.

Contact an Experienced Palm Harbor, FL, Foreclosure Attorney

Foreclosure can feel like a setback, but it doesn’t have to define your financial future. With the right steps, you can rebuild your credit, regain stability, and move forward confidently. At the Law Offices of Jeffrey A. Herzog, P.A., we’re here to help you every step of the way. Contact us today for a consultation, and let’s work together to protect your financial well-being and create a stronger path forward.